Phone : +918147282686

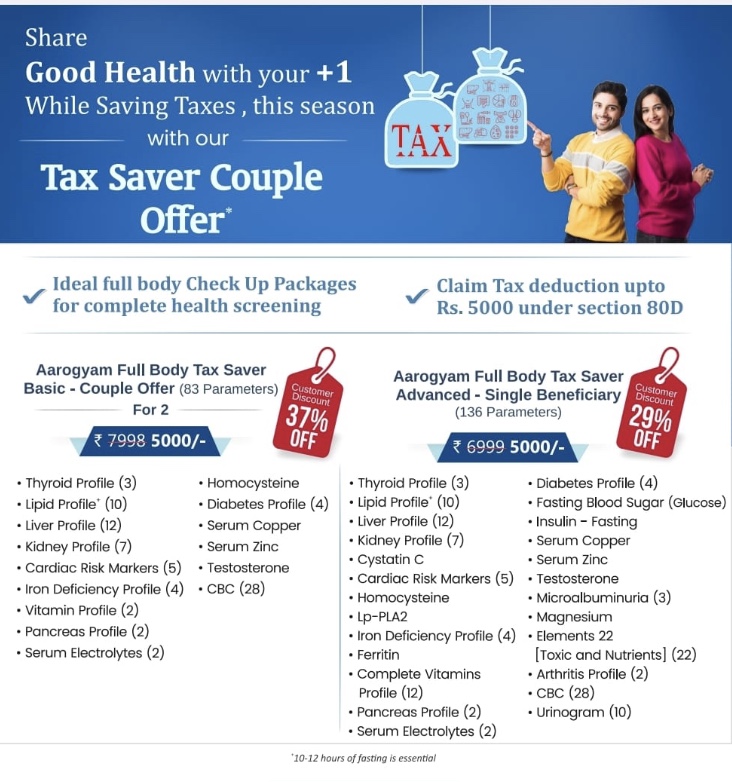

TAX SAVING MEDICAL OFFER

GRAB THIS OPPORTUNITY OF TAX BENEFITS WHILE YOU PRIORITISE YOUR HEALTH

This offer can be availed through R S Diagnostic centre , Yelahanka.

The Aarogyam full tax saver is a health insurance policy offered by various insurance companies in India. Under Section 80D of the Income Tax Act, premiums paid for health insurance policies, including Aarogyam full tax saver, are eligible for tax benefits. Here are a couple of tax benefits you can avail through Aarogyam full tax saver:

1. Deduction on Premium Paid: You can claim a deduction for the premium paid towards the Aarogyam full tax saver policy for yourself, your spouse, children, and parents. The maximum deduction allowed depends on the age of the insured individuals and is subject to certain limits specified by the Income Tax Act.

2. Preventive Health Check-up: Some health insurance policies, including Aarogyam full tax saver, offer coverage for preventive health check-ups. The expenses incurred for such check-ups can also be claimed as a deduction under Section 80D, subject to certain limits.

Tag

TAX BENEFITSTAX SAVING MEDICAL OFFERCOUPLE TAX BENEFITS OFFEREnquiry

Get in touch

R S DIAGNOSTIC CENTRE.All Rights Reserved © 2026